Exclusive Offer

-40% Off

Grocery full of inspiration

Only this week. Don’t miss...

from $6.99

Shop Now

Exclusive Offer

-20% Off

Specialist in the grocery store

Only this week. Don’t miss...

from $7.99

Shop Now

Exclusive Offer

-40% Off

Grocery full of inspiration

Only this week. Don’t miss...

from $6.99

Shop Now

Exclusive Offer

-20% Off

Specialist in the grocery store

Only this week. Don’t miss...

from $7.99

Shop Now

Exclusive Offer

-40% Off

Grocery full of inspiration

Only this week. Don’t miss...

from $6.99

Shop Now

Download the Bacola App to your Phone.

Order now so you dont miss the opportunities.

Your order will arrive at your door in 15 minutes.

Trending Products

USDA Choice Angus Beef Stew Meat

Warrior Blend Organic

Encore Seafoods Stuffed Alaskan Salmon

Vital Farms Pasture-Raised Egg Bites Bacon & Cheddar

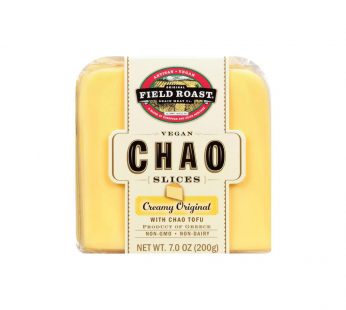

Field Roast Chao Cheese Creamy Original

Customer Comment

Best Sellers

Do not miss the current offers until the end of March.

Vital Farms Pasture-Raised Egg Bites Bacon & Cheddar

In Stock

Rated 4.00 out of 5

1 Ratings

All Natural Italian-Style Chicken Meatballs

In Stock

Store:amazon

Rated 4.00 out of 5

1 Ratings

Angie’s Boomchickapop Sweet & Salty Kettle Corn

In Stock

Store:migros

Rated 4.00 out of 5

1 Ratings

Field Roast Chao Cheese Creamy Original

In Stock

Store:harrier

Rated 5.00 out of 5

1 Ratings

Blue Diamond Almonds Lightly Salted

In Stock

Store:migros

Rated 5.00 out of 5

1 Ratings

Vital Farms Pasture-Raised Egg Bites Bacon & Cheddar

In Stock

Rated 4.00 out of 5

1 Ratings

All Natural Italian-Style Chicken Meatballs

In Stock

Store:amazon

Rated 4.00 out of 5

1 Ratings

Angie’s Boomchickapop Sweet & Salty Kettle Corn

In Stock

Store:migros

Rated 4.00 out of 5

1 Ratings

Field Roast Chao Cheese Creamy Original

In Stock

Store:harrier

Rated 5.00 out of 5

1 Ratings

Blue Diamond Almonds Lightly Salted

In Stock

Store:migros

Rated 5.00 out of 5

1 Ratings

Vital Farms Pasture-Raised Egg Bites Bacon & Cheddar

In Stock

Rated 4.00 out of 5

1 Ratings

HOT PRODUCT FOR THIS WEEK

Dont miss this opportunity at a special discount just for this week.

19%

Chobani Complete Vanilla Greek Yogurt

1 kg

In Stock

67

:

03

:

36

:

37

Remains until the end of the offer

NEW PRODUCTS

New products with updated stocks.

All Natural Italian-Style Chicken Meatballs

In Stock

Store:amazon

Rated 4.00 out of 5

1 Ratings

Angie’s Boomchickapop Sweet & Salty Kettle Corn

In Stock

Store:migros

Rated 4.00 out of 5

1 Ratings

Field Roast Chao Cheese Creamy Original

In Stock

Store:harrier

Rated 5.00 out of 5

1 Ratings

Add to Wishlist

Add to Wishlist

Foster Farms Takeout Crispy Classic Buffalo Wings

In Stock

Store:amazon

Rated 4.00 out of 5

1 Ratings

Blue Diamond Almonds Lightly Salted

In Stock

Store:migros

Rated 5.00 out of 5

1 Ratings

Chobani Complete Vanilla Greek Yogurt

1 kg

In Stock

Store:amazon

Rated 5.00 out of 5

1 Ratings

Beverages

11 Items

Biscuits & Snacks

6 Items

Breads & Bakery

6 Items

Breakfast & Dairy

8 Items

Frozen Foods

7 Items

Fruits & Vegetables

12 Items

Grocery & Staples

7 Items

Household Needs

1 Items

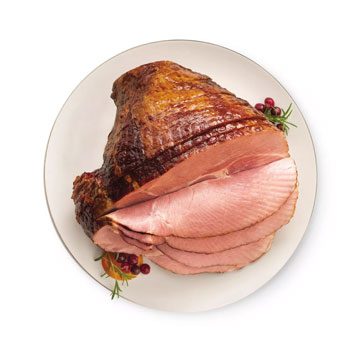

Meats & Seafood

5 Items

The Best Marketplace

Tina Mcdonnell

Sales Manager